Schools

We equip teachers with everything needed to confidently deliver financial education - no expertise required.

How We Help Schools

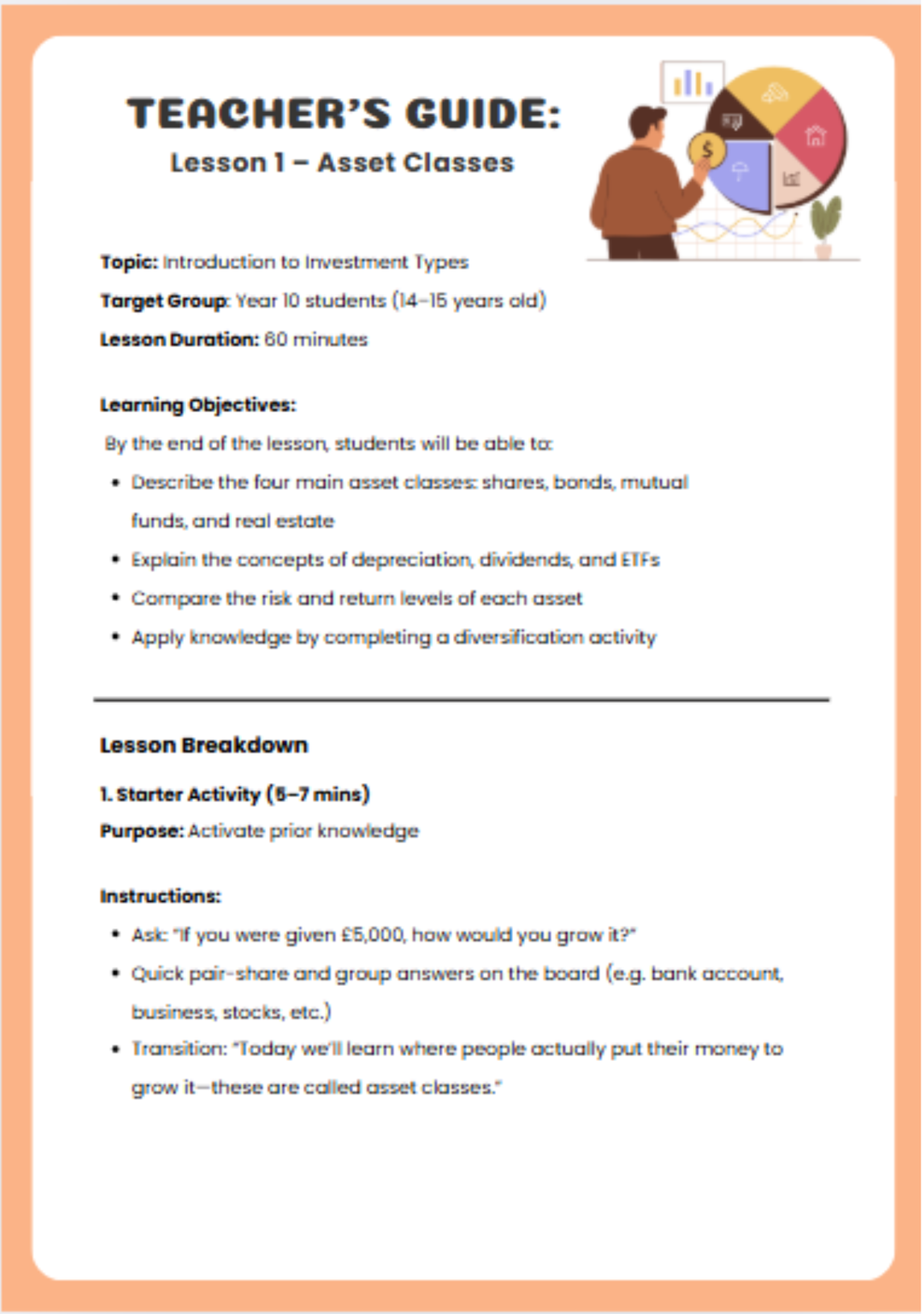

Ready-to-Teach Curriculum

Our five-tiered curriculum programme guides students from basic money concepts to making complex real-world financial decisions.

Flexible Funding Options

Contact us to discuss subsidised implementation.

We provide everything needed

Ready-to-use lesson plans (aligned to PSHE/Citizenship/Mathematics)

Interactive activities and quizzes

Classroom-ready gamified simulations

We also offer focused teacher-training sessions, so staff feel confident and equipped to discuss money matters in any classroom.

Classroom-Ready Gamified Simulations

Our flagship innovation is our immersive finance-simulation games: the country’s top-rated way to hook every student and turn money theory into real-world action.

The feedback for this has been truly astonishing from students and teachers.

“I would like to thank you for running a session that was engaging and very informative. Our pupils enjoyed this and the conversations the questions created were very mature and really made our pupils think. I am yet to receive any negative feedback as all pupils who have since spoken to me told me how much fun they had. Thanks again and I look forward to working with you again soon.”

- Rebecca Hoban Deputy Head of Maths at De Lacy Academy

Case Studies